omaha ne sales tax calculator

Make a Payment Only. Real property tax on median home.

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

How much is sales tax in omaha.

. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Sales Tax State Local Sales Tax on Food. The Nebraska state sales and use tax rate is 55 055.

Name A - Z Sponsored Links. Its a progressive system which means that taxpayers who earn more pay higher taxes. The nebraska state sales and use tax rate is 55 055.

Method to calculate Omaha sales tax in 2021. If youre an online business you can connect TaxJar directly to your shopping cart and. Driver and Vehicle Records.

Nebraskas state income tax system is similar to the federal system. The Nebraska state sales and use tax rate is 55 055. Sales Tax Calculator in Omaha NE.

The current total local sales tax rate in Omaha NE is 7000. Taxes-Consultants Representatives Tax Return. Registration Fees and Taxes.

The Omaha Nebraska sales tax rate of 7 applies to the following 39 zip codes. Taxes-Consultants Representatives Tax. The calculator will show you the total sales tax amount as well as the county city.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. The Nebraska sales tax rate is currently. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

This is the total of state county and city sales tax rates. Sales Tax Calculator in Omaha NE. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Sales Tax State Local Sales Tax on Food. Method to calculate Omaha sales tax in 2022. Request a Business Tax Payment Plan.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Name A - Z Sponsored Links. Sales Tax Rate Finder.

Sales tax in omaha nebraska is currently 7. Real property tax on median home. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Sales and Use Tax.

There are four tax brackets in. The December 2020 total local sales tax rate was also 7000.

Nebraska Income Tax Calculator Smartasset

What You Need To Know About Omaha Property Taxes Mortgage Specialists

Nebraska State Tax Things To Know Credit Karma

How Much Does It Really Cost To Sell A House In Nebraska

Schedule Jeep Service Online Ram Repairs In Omaha Ne

Car Loan Calculator Metro Credit Union Omaha Ne Best Loans Rates

Omaha Property Taxes Explained 2022

The Ultimate Guide To Ecommerce Sales Tax In 2022

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

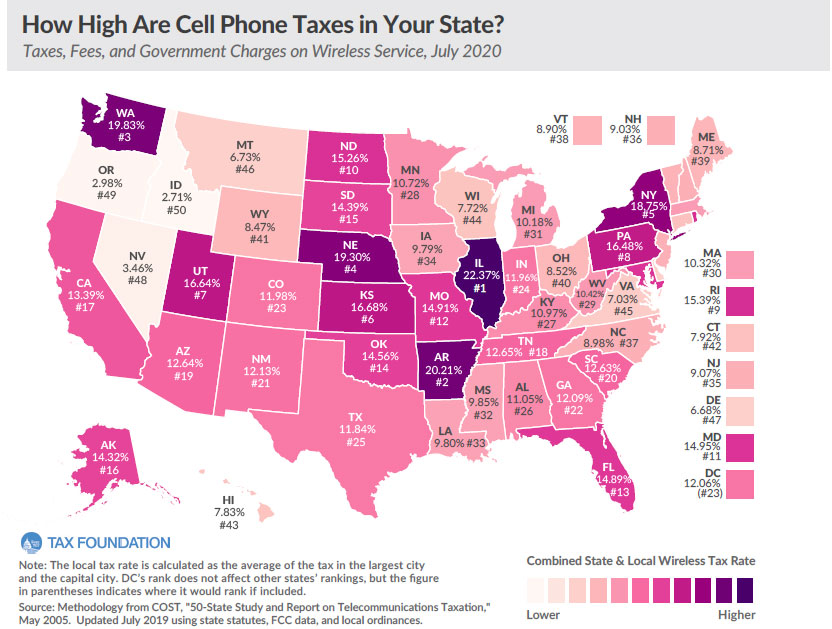

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

U S Cities With The Highest Property Taxes

Cell Phone Taxes And Fees In 2018 Tax Foundation

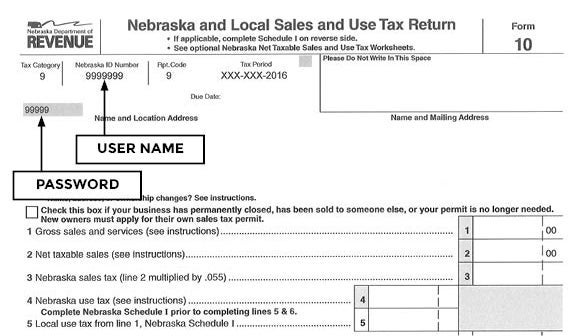

Online Sales And Use Tax Filing Faqs Nebraska Department Of Revenue

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Nebraska Sales Tax Calculator And Economy 2022 Investomatica

Nebraska Sales Tax Guide For Businesses

Nebraska Income Tax Calculator Smartasset

Should You Move To A State With No Income Tax Forbes Advisor