child tax credit 2021 portal

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Get your advance payments total and number of qualifying children in your online account.

Child Tax Credit Payments Unenrollment Process Lupe Ruiz

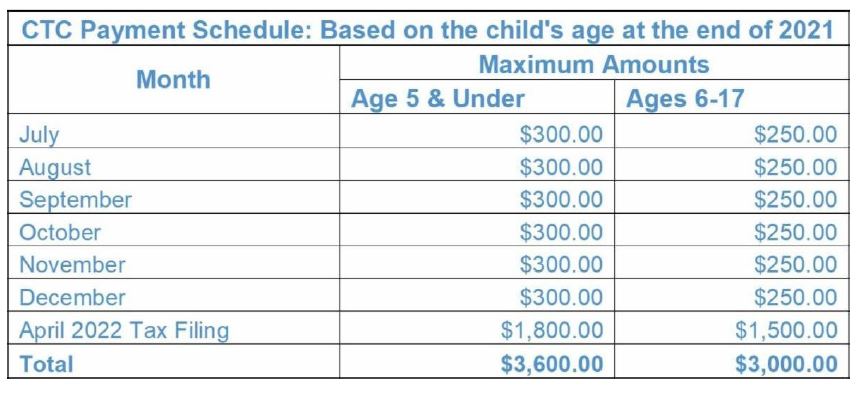

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

. The Child Tax Credit Update Portal and Child Tax Credit Non-filer. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The IRS recently upgraded the.

Connecticut State Department of Revenue Services. It has gone from 2000 per child in 2020 to 3600 for. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America.

The Child Tax Credit provides money to support American families. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. Specifically the Child Tax Credit was revised in the following ways for 2021.

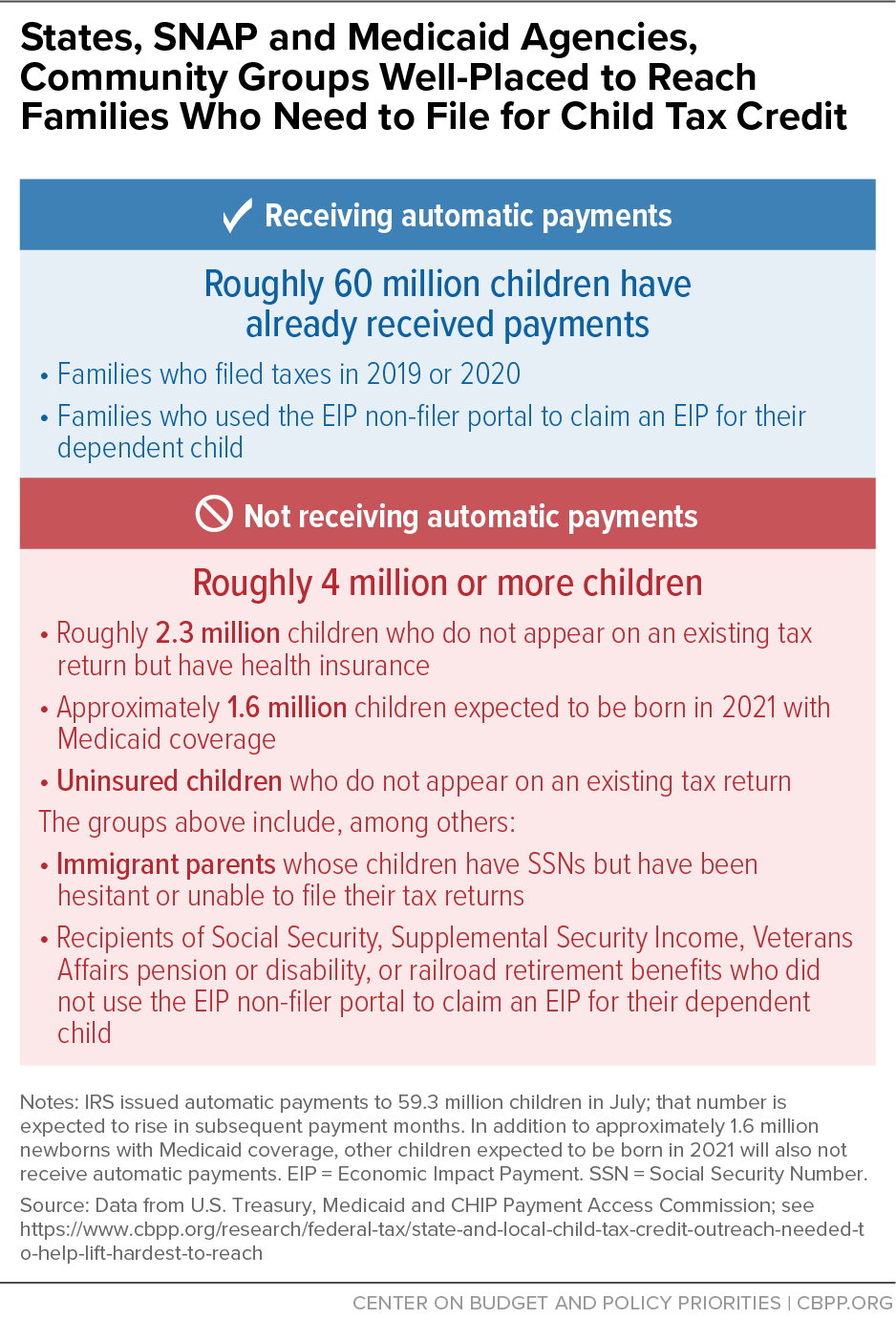

The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. The expanded Child Tax Credit CTC for 2021 was a part of the American Rescue Plan Act ARPA signed into law by President Biden to get pandemic cash assistance to more families. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

The timeframe for receiving advance payments of the Child Tax Credit CTC during 2021 has expired. You can use your username and password for the. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Department of Revenue Services. 3600 for children ages 5 and under at the end of 2021. 150000 if you are married and.

3000 for children ages. How Does The Updated Credit Work. Find out if you qualify for the Child Tax Credit in 2021 and how to claim it on your taxes.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families. The credit amount was increased for 2021.

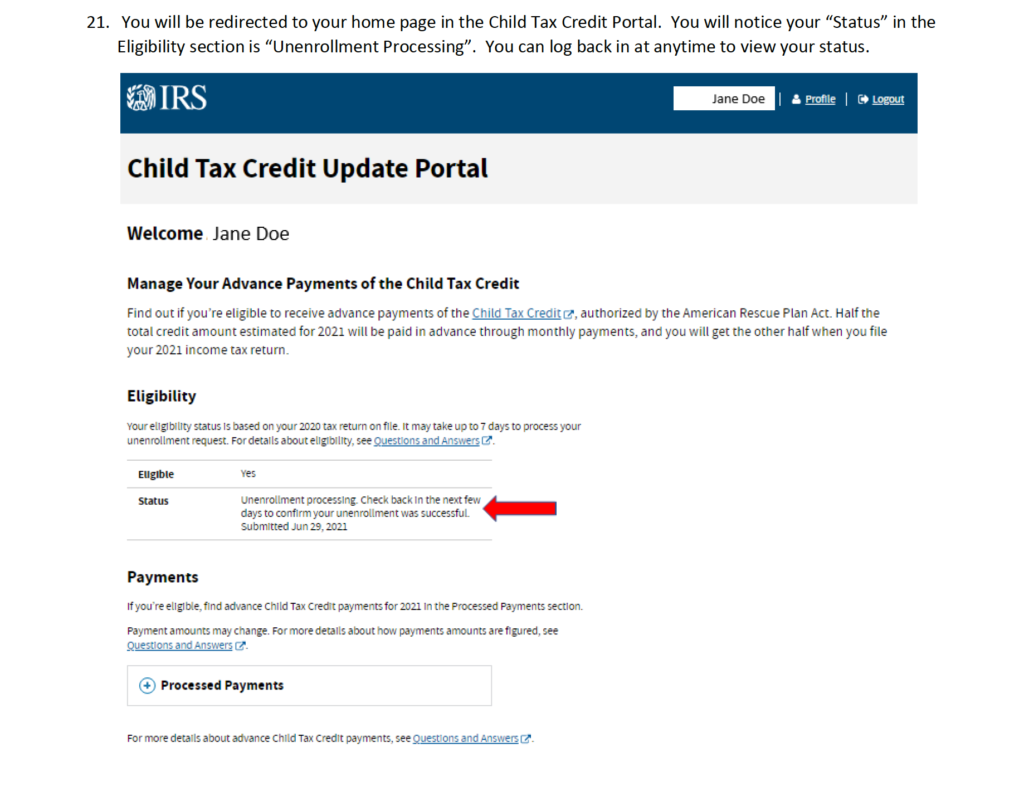

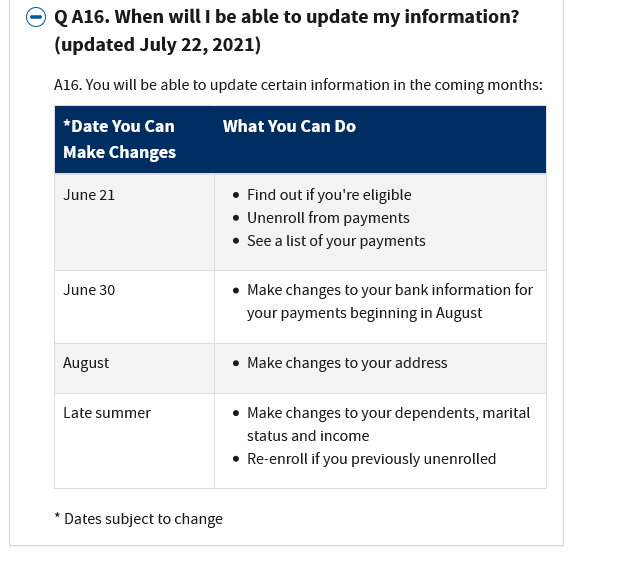

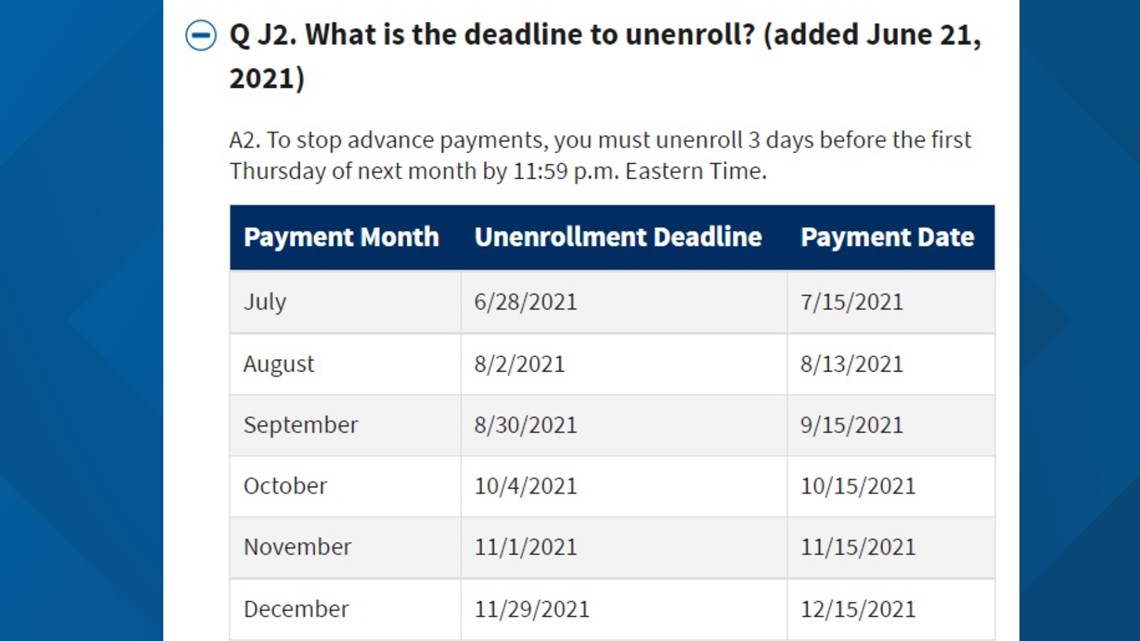

The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. 2021 Tax Filing Information.

The IRS will pay 3600 per child to parents of young children up to age five. Half of the money will come as six monthly payments and half. The IRS pre-paid half the total credit amount in monthly payments from.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The American Rescue Plan increased the amount of the Child Tax. Here is some important information to understand about this years Child Tax Credit.

COVID Tax Tip 2021-101 July 14 2021.

The Child Tax Credit Update Portal Jaime Andrade Jr State Representative

Child Tax Credit Update Portal Internal Revenue Service

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Child Tax Credit Update Portal 2021 2022

Irs Launches New Online Tool To Help Manage Child Tax Credit Nextadvisor With Time

Child Tax Credit How To Unenroll Accounting For Jewelers

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Irs Child Tax Credit Is The Web Portal The Best Way To Apply What Other Options Do I Have As Usa

Advancements In The Child Tax Credits Quality Back Office

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

How To Opt Out Of The Advance Child Tax Credit Payments

Advanced Child Tax Credit Payments Miller Verchota Cpas

Child Tax Credit What To Do If You Haven T Gotten Your Payment Yet

Child Tax Credit Irs New Online Portal Help Families Plan Ahead In Payments

Should You Be Getting Monthly Payments For Your Kids Check The Irs S Child Tax Credit Portal Kiplinger

I Got My Refund Ctc Portal Updated With Payments Facebook

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com