can you ever owe money on stocks

Selling Stocks on a Margin. You may also owe money on stocks if you trade see on a margin account.

Do You Have Unclaimed Property Money Saving Strategies Personal Financial Planning Unclaimed Money

So can you owe money on stocks.

. However if you buy stocks using borrowed money you will need to repay your debt regardless. When you are trading with a borrowed money any loss you make is multiplied by the leverage. The price of the stock has to drop more than the percentage of margin you used to fund the purchase in order for you to owe money.

Three ways to make money in the stock market are. If youre using your own money to invest in shares without using any advanced techniques to trade then the answer is no. You could be owed THOUSANDS from these companies heres from happinessmancouk.

Can you lose more than you put in on Robinhood. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. If you dont use any margin at all youll never owe money on a stock.

There are specific instances where a person can be in debt from stock purchases. It really depends on whether youre buying stocks on a margin loan or with cash. This can happen when a stock is declining in value as well as when it is appreciating in value.

When a person buys a security on margin a broker is lending money to purchase securities beyond what the individual has available in his or her account. The price of the stock has to drop more than the percentage of margin you used to fund the purchase in order for you to owe money. However while this cannot happen the book value can go negative and you can lose more money than you invested or end up in debt.

It really depends on whether youre buying stocks on a margin loan or with cash. Can a Stock Go Negative. Answer 1 of 3.

The simplest tax errors--including errors of omission--can be the most costly. Stock prices can technically go to 0 but they can never go negative. You would then owe the lender 100 shares at some point in the future.

If a stock drops in price you wont necessarily owe money. The broker funds you with 50 of your account value. Read on to learn the circumstances.

Even if you borrow to buy shares or funds or whatever youll get a margin call and automatic closeout liquidation of your position before you go negative. It limits the amount of money you can lose in a trade. Yes if you use leverage by borrowing money from your broker with a margin account then you can end up owing more than the stock is worth.

Can You Ever Owe Money On Stocks. Do I owe money if a stock goes down. Losing money in the stock market happens quite often.

While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. Even though the value of a stock can never go below zero it is possible to lose more than what you invested in the stock market and end up with a debt. The investor uses the credit line to buy stocks.

Lets take a look at the two possible situations when this can happen. You cannot have negative money in stocks because even if the price of your stocks fluctuates or falls drastically it cannot attain a value less than zero. Can you ever owe money on stocks.

It all depends on whether youre purchasing stocks with cash or on a margin loan. Yes you can owe money on stocks if you buy stocks through a margin account because a margin account allows an investor to buy stocks on credit. Yes if you use leverage by borrowing money from your broker with a margin account then you can end up owing more than the stock is.

If your stocks bonds mutual funds ETFs or other securities lose value you wont normally owe money to your brokerage. You can withdraw contributions. At least you SHOULD with any decent broker.

While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. Sell stock shares at a profitthat is for a higher price than you paid for them. In a margin account a brokerage or investment bank extends a line of credit or margin to an investor.

5 Ways to Protect Your Money. Margin borrowing available at most brokerages allows investors to borrow money to buy stock. Major indexes like the New York Stock Exchange will actually de-list stocks that.

The purchased stock is collateral for the loan. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000 or 100. Technically yes but practically no.

While there are risks involved with investing there are steps you can take to protect your money. Can you go negative on stocks. Yes you can owe money on stocks if you buy stocks through a margin account because a margin account allows an investor to buy stocks on credit.

However you may not receive all of your money back ifwhen you sell. A shady one might not liquidate or might liquidate early or never put on your trade in the first place. You wont lose more money than you invest even if you only invest in one company and it goes bankrupt and stops trading.

Stocks Sold on a Margin Can you owe money in stocks. A company can lose all its value. Can you owe money in stocks.

These accounts allow investors to buy stock shares worth more than what they have. The site made headlines when a group of users from a sub-forum called rWallStreetBets got together. You wont generally owe money to your brokerage if your stocks bonds ETFs mutual funds or other assets lose value.

However you could not get all of your money back when you sell. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. 0 Can You Ever Owe Money When Investing.

Let me simplify this for you even more--get to a trusted tax pro who can handle this for you while you run your business. If a stock drops in price you wont necessarily owe money. The investor can pay 50 of the stock shares and fund the remaining 50 using debt.

If you invest in stocks with a cash account you will not owe your broker money even if the stocks go to zero. If your stocks bonds mutual funds ETFs or other securities lose value you wont.

Algorithmic Trading Stock Ideas Stock Exchange Stock Market Stock Trading

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

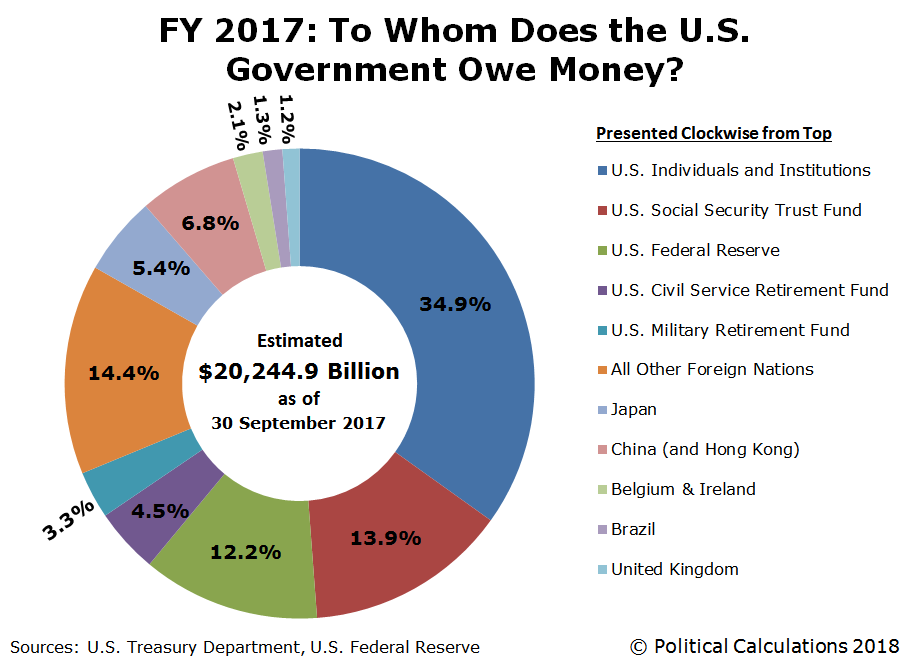

To Whom Does The U S Government Owe Money Seeking Alpha

What To Do When Debt Collectors Call Even If You Don T Owe Money Debt Collector Debt Credit Debt

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

How To Invest Your Money When Inflation Is High Of Dollars And Data Investing Wealth Management Owe Money

Have Your Money Work For You So That You Can Stop Working For Your Money Click The Link In Our Bio To Join Us No Investment Quotes Work On Yourself Investing

How To Invest Your Money When Inflation Is High Of Dollars And Data Investing Wealth Management Owe Money

What Happens If I Buy A Stock And It Goes Down

Discover Your Networth Financial Education Cash Credit Card Student Loans

Pin On Investment Advice Group Board

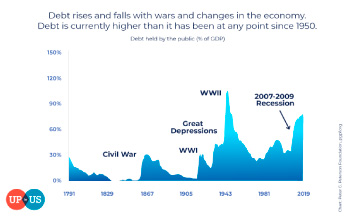

Who Does The Us Owe Money To 2020 Update I Up To Us

Secrets To Lowering Your Taxes In Retirement Bottom Line Inc Stylish Shirts The Motley Fool Yellow Background

How To Pay Of Debt Quickly Debt Payoff Personal Finance Budgeting

How To Calculate Your Net Worth And Why It Matters People Talk About How To Save More Money How To Improve Your Credit Score Owe Money Personal Finance

The Best Free Financial Products To Help You Save Thousands Saving Money Budgeting Budgeting Tips

Can You Owe Money On Stocks The Motley Fool

7 Practical Steps To Actually Obliterate And Conquer Your Debt And Leave It In The Past Debt Relief Programs Student Loan Debt Forgiveness Owe Money